Income Tax 87a Rebate Ay 2025-24. The union budget for fy24 introduced marginal tax relief in the new tax regime. The total income eligible for rebate under section 87a has increased from inr 5,00,000 to inr 7,00,000 for taxpayers opting for the new tax regime.

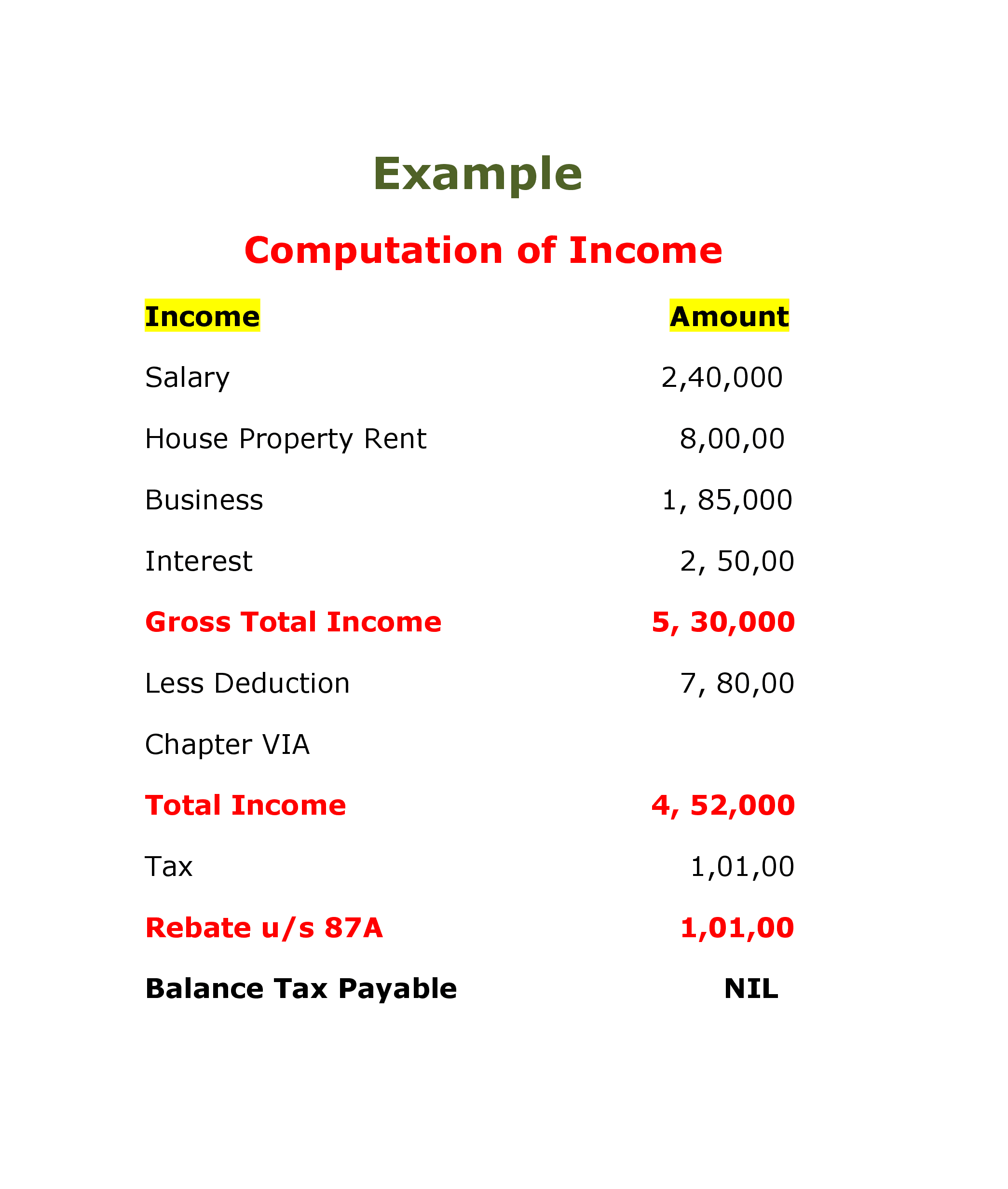

Tax rebate up to rs.12,500 is applicable for resident individuals if the total income does not exceed rs.

Exemption under section 87A With Automatic Tax Form 16 Part A, 7 lakhs in new tax regime. The union budget for fy24 introduced marginal tax relief in the new tax regime.

Tax Rebate under Section 87A, 7,00,000 under the new tax regime. 7,00,000 under the new tax regime.

Tax Rebate under Section 87A Legalraasta, Tax rebate up to rs.12,500 is applicable for resident individuals if the total income does not exceed rs. In case your total income is below rs 5 lakh, then you are eligible for a tax rebate.

Rebate u/s 87A of Tax Act, 1961 Tax Act, It is a welcome initiative for those whose income marginally exceeds the rs 7.5. For the new tax regime, rebate under section 87a is available to resident individuals whose total income during the previous year does not exceed rs.

Budget 202324 Finance Bill, 2025 Rates of Tax, Rates of TDS, The union budget for fy24 introduced marginal tax relief in the new tax regime. 5,00,000 can claim a tax rebate u/s 87a.

87A Rebate का नया नियम आयकर Rebate u/s 87A कैसे प्राप्त करे? How to, Budget 2025 announced that individuals will not have to pay any tax if the taxable income does not exceed rs 7 lakh in a financial year. The rebate under section 87a has been doubled to ₹25,000 for qualifying individuals.

Changes in Section 87A of Act (Tax Rebate) Effective from 1, It allows you to claim the refund if your yearly income does not exceed. In case your total income is below rs 5 lakh, then you are eligible for a tax rebate.

Tax Rebate Under Section 87A Goyal Mangal & Company, Under this regime, if you are a resident. Therefore, a resident with taxable income up to rs 7,00,000 will get rs 25,000 or the amount of tax due as a tax credit.

Tax Rebate Under Section 87A Claim for FY 202021, AY 202122, For the new tax regime, rebate under section 87a is available to resident individuals whose total income during the previous year does not exceed rs. Section 87a rebate is an income tax provision that allows taxpayers to lower their tax liability.

Is Section 87A Rebate for everyone? SR Academy India, 7,00,000 under the new tax regime. The union budget for fy24 introduced marginal tax relief in the new tax regime.