New York State Estimated Tax Payments 2025. Estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year.

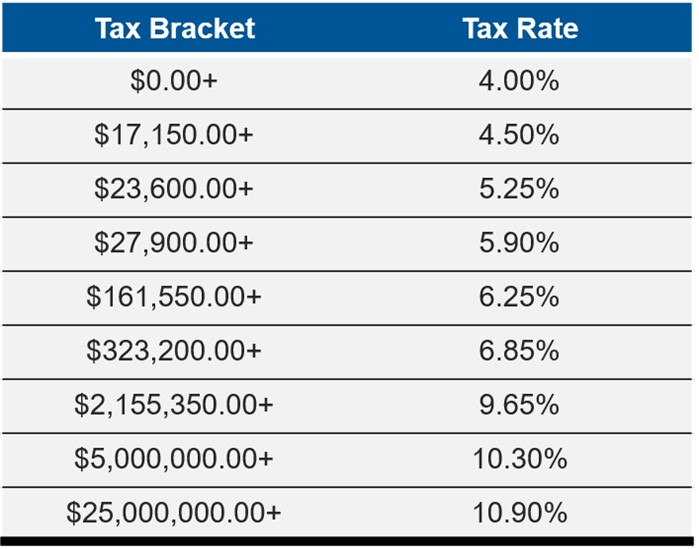

In parts of the state, like new york city, all types of taxes are even higher. You may be required to make estimated tax payments to new.

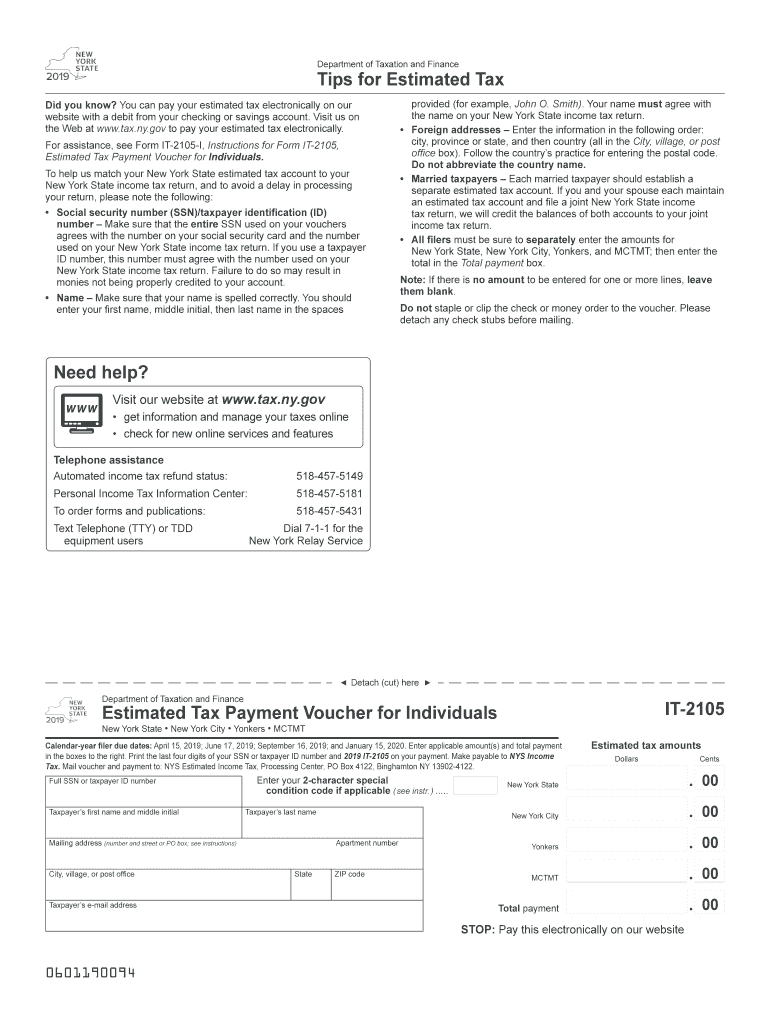

New York State Taxes What You Need To Know Russell Investments, 2025 personal income tax forms. Estimated income tax payment voucher;

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The new york tax estimator. When are quarterly estimated tax payments due?

IRS & NY State Estimated Tax Payments [ 6 Must Know FAQs ], To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year. Your final estimated tax payment is due on january 16, 2025.

![IRS & NY State Estimated Tax Payments [ 6 Must Know FAQs ]](https://mllpaaohajz4.i.optimole.com/wOAfOhU.attW~68a3b/w:auto/h:auto/q:mauto/https://taxproblemlawcenter.com/wp-content/uploads/2018/12/GST-502-23.jpg)

Fill Free fillable Form 1. IT2105.1 Reconciliation of Estimated Tax, Estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. If i anticipate a sizable capital gain on the sale of an.

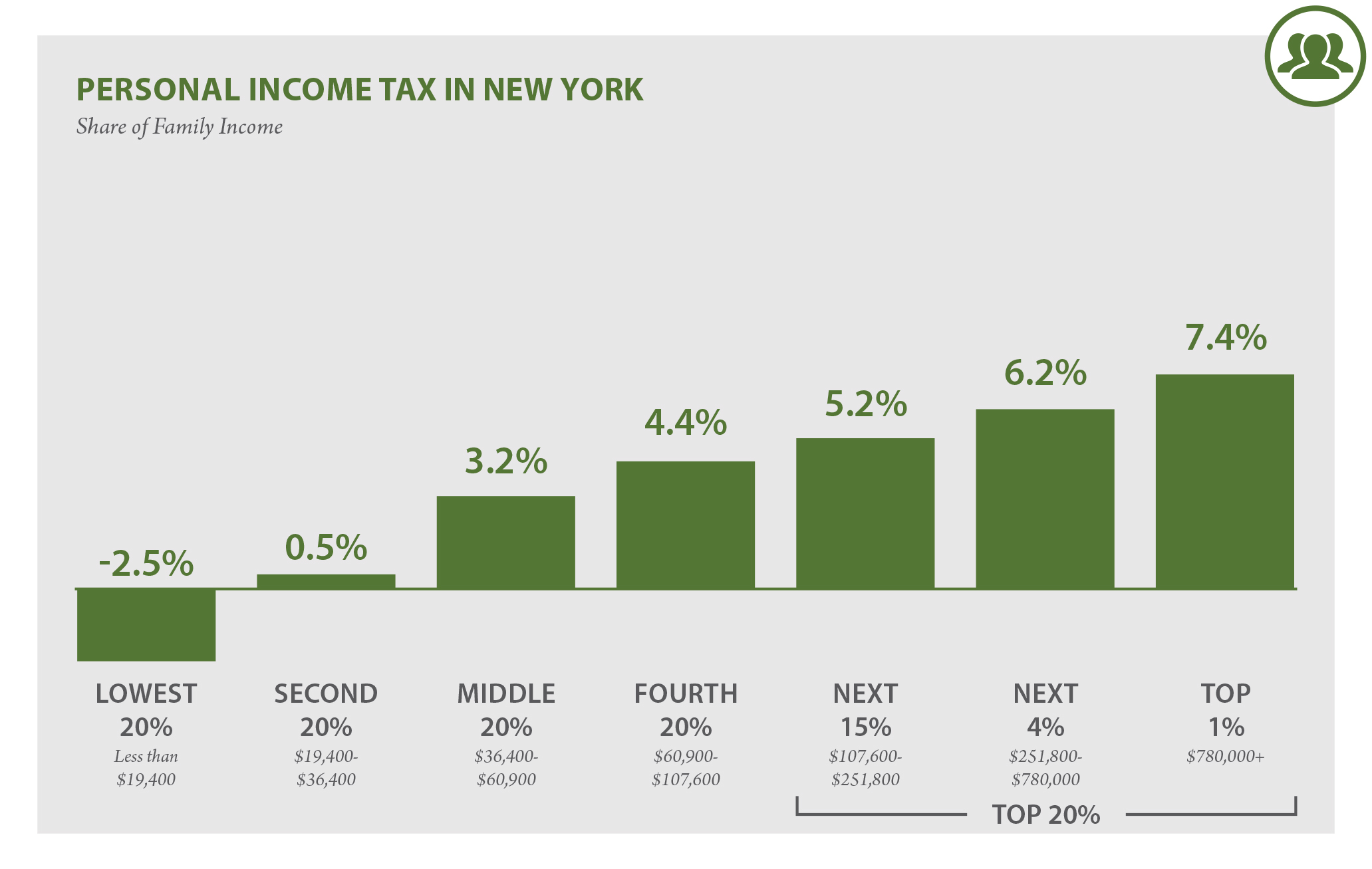

We’re 1 New Yorkers pay highest state and local taxes, Federal quarterly estimated tax 4th. You may be required to make estimated tax payments to new.

Quarterly Tax Calculator Calculate Estimated Taxes (2025), Enter your financial details to calculate your taxes. Oneida common council meeting of march 5, 2025.

New York State Estimated Tax Form 2025 Printable Forms Free Online, Enter your financial details to calculate your taxes. 2025 personal income tax forms.

New York Who Pays? 6th Edition ITEP, How do you make estimated tax payments? Four of these options are based on a percentage of tax from both the prior year and the current year.

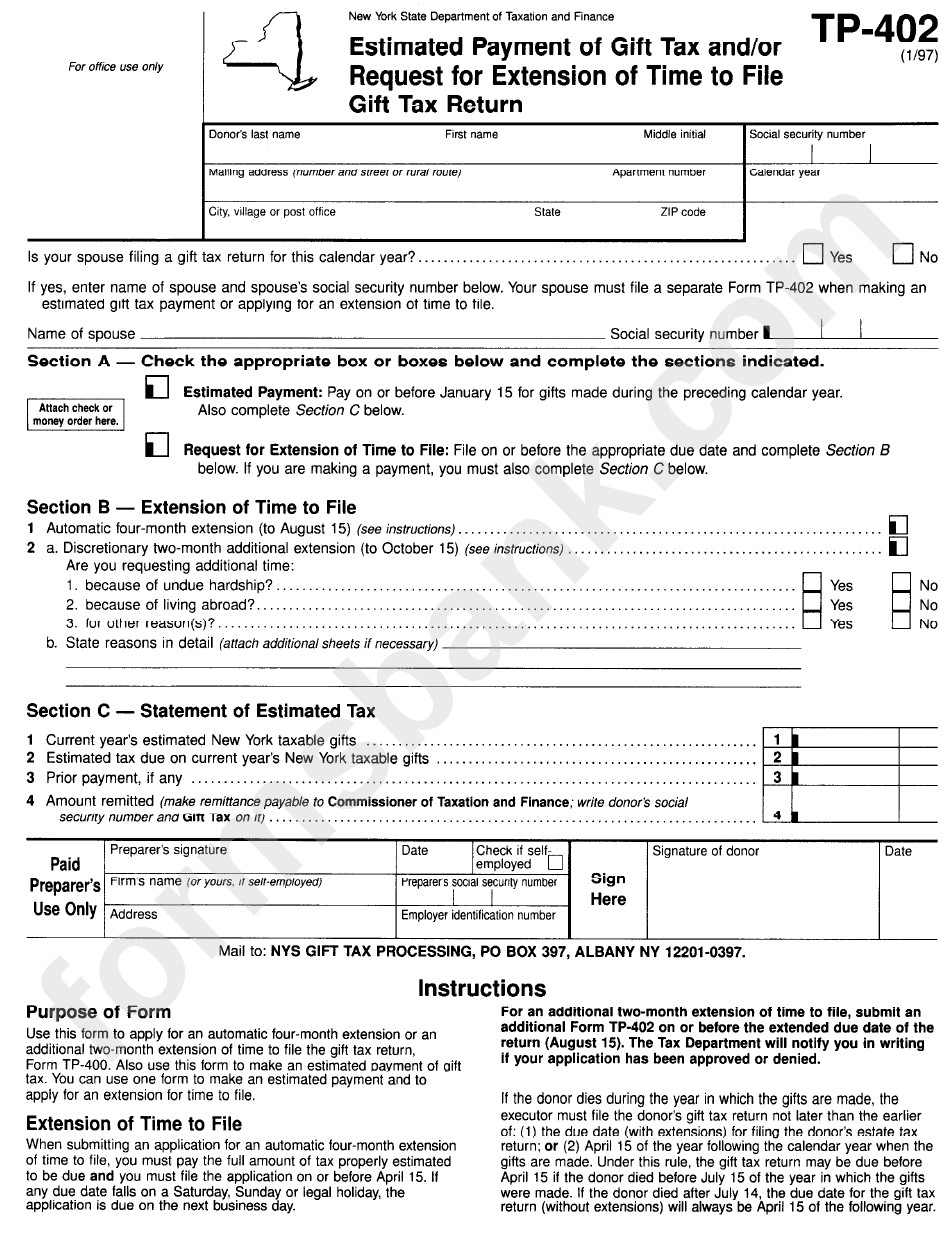

Form Tp402 Estimated Payment Of Gift Tax And/or Request For, Solved•by turbotax•19336•updated 5 days ago. If you're behind, there's still time to catch up.

IRS 2025 Estimated Tax Payments Scribe, Top frequently asked questions for estimated tax. Payments due april 15, june 17, september 16, 2025, and january 15, 2025.

If your clients missed any of the prior due dates for 2025, they should pay as soon as possible to avoid interest and.

You can either pay all your estimated tax with this first payment or pay it in four equal installments due on: